It’s that wonderful tax time of year again when we all gather our paperwork and bombard our accountants with a mountain of information. Here are some helpful tips:

If you bought:

- Your mortgage company will send you a 1098, which you’ll use to deduct the interest paid in 2013. It will NOT include any prepaid interest, origination fees, etc. that you paid as part of your closing costs. You must remember to take them from your HUD1 closing statement.

- If the property was an investment, remember to show your tax preparer any prepaid condo/HOA fees, interest or taxes shown on your HUD1.

- Also for investment properties, don’t forget to save all of those receipts for any work you did on the property.

- If you sold stocks or bonds to use as your down-payment, don’t forget to tell your tax preparer about those as well, although you should get a 1099 from the financial institution you went through.

If you sold:

- If this home was your primary residence for at least 2 years, you’ll most likely be exempt from paying taxes on your Capital Gains (up to $250k if you’re single, or up to $500k if you’re married). Make sure when you show the sale price to your tax preparer, you also show them how much you paid.

- Bring your HUD1 closing statement with you to show any taxes paid as a proration or credit to the purchaser, or any other costs associated with selling.

- If this was an investment, you’ll also have to consider depreciation during the length of which you owned the home when trying to calculate taxes owed on the sale.

For Homeowners:

- Keep all of the receipts from work you had done on the property. Your CPA can help decipher what qualifies as maintenance and what qualifies as improvements. Some of it you can deduct, others you cannot.

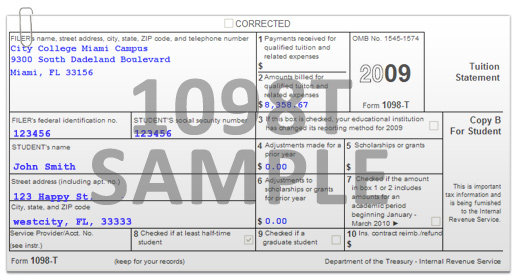

- You’ll get a 1098 from your financial institution which will show any interest you paid to them during the year.

- Depending on who pays your real estate taxes (those without a mortgage will pay them directly, others will have escrow accounts with your financial institution who will pay them on your behalf), remember to bring that information with you as well.

I’ve already sent everyone who bought and/or sold with me in 2013 a copy of their HUD1 statement to help with preparing their taxes. Dig yours out!