Recently I helped a client try to determine which lender was going to give the best rate and deal on the purchase of a new home. Part of that means trying to determine the difference between origination fee and discount points. Here’s a brief explanation of the difference and pros/cons of each:

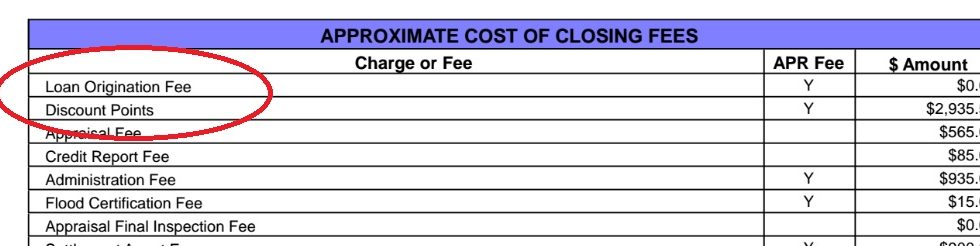

Loan Origination Fee: A charge a lender asks a buyer to pay to actually give and process the loan. It is NOT tax deductible. It is basically a fee to create the mortgage. It gives no benefit to the buyer.

Discount Points: An upfront fee paid by a buyer to reduce the interest rates. It is a percentage of the loan value (i.e. Loan Value of $400,000 makes a Discount Point $4,000 but will save you $ each month on the mortgage payment). The biggest benefit: this is TAX DEDUCTIBLE and paid at closing as part of your closing costs.

Why would you buy down the rate (i.e. use discount points)? If you’re planning on staying in a house for the long term, the cash savings each month will be more than your cash up front to buy down the rate. For example, if you paid $4,000 upfront at closing, but it brings your monthly payment down by $100, you’d have to be in the property for at least 40 months (3 years, 4 months) for them to break even and recoup that cost.

Make sure you’re evaluating things clearly to know what you’re really getting in a mortgage. It’s not always about just the rate. Look for junk fees too.